5 Things to Know Before the Stock Market Opens

- quinnvaras

- Mar 20

- 3 min read

Stock futures edged higher ahead of the Federal Reserve’s interest rate decision, signaling cautious optimism among investors. Meanwhile, Nvidia made headlines with the debut of its latest AI chips, and Google finalized a $32 billion acquisition of cloud security startup Wiz. Here’s what investors need to know before markets open today.

1. Market Streak Ends as Sell-Off Resumes

Stocks ended a two-day winning streak on Tuesday as all three major U.S. indexes sharply declined. The S&P 500 fell 1.07%, bringing its total decline to 8.6% from its February record close and pushing it back toward correction territory.

The Dow Jones Industrial Average dropped 260.32 points (-0.62%).

The Nasdaq Composite, already in correction mode, led losses with a 1.71% decline.

Amid heightened volatility, the UCLA Anderson Forecast issued its first-ever “recession watch,” citing potential economic risks stemming from President Donald Trump’s policies. Investors are closely monitoring market movements as concerns over inflation, interest rates, and fiscal policy uncertainty persist.

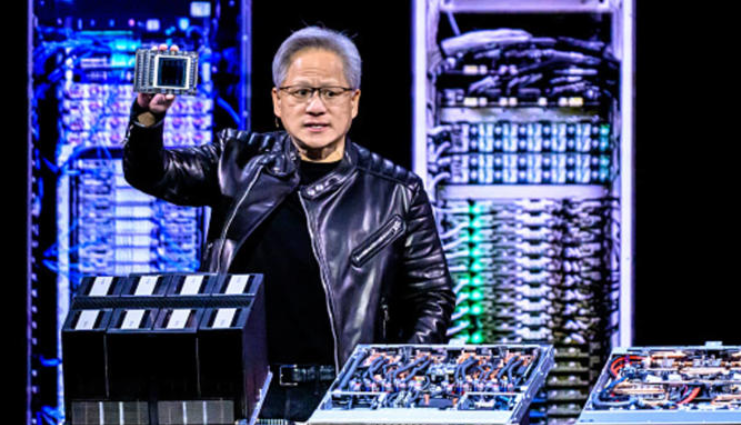

2. Nvidia Unveils Cutting-Edge AI Chips at GTC Conference

Nvidia’s CEO Jensen Huang announced the company’s latest AI advancements at its highly anticipated GTC conference, unveiling:

Blackwell Ultra chip family – a next-generation AI processor aimed at enhancing efficiency in data centers.

Vera Rubin GPU – Nvidia’s most advanced graphics processing unit, designed to accelerate AI and machine learning applications.

Additionally, Nvidia revealed a strategic partnership with General Motors, integrating its AI technology into GM’s next-generation vehicles, driver-assistance systems, and manufacturing processes. Investors responded with keen interest, as the announcement underscores Nvidia’s continued dominance in the AI sector.

3. Trump, Putin Announce Ceasefire Agreement on Energy & Infrastructure

President Donald Trump and Russian President Vladimir Putin reportedly agreed to an “immediate ceasefire on all energy and infrastructure” in Ukraine following a 90-minute phone call between the two leaders.

The Kremlin’s readout confirmed that Russia and Ukraine agreed not to attack each other’s energy infrastructure for 30 days.

Trump posted on Truth Social, stating that efforts will continue toward a “Complete Ceasefire” and an end to the war.

This development marks a significant shift in diplomatic discussions, but analysts remain skeptical about its long-term impact on global markets and geopolitical stability.

4. Google’s $32 Billion Wiz Acquisition Signals Major Tech Deal

Google announced its largest-ever acquisition, agreeing to purchase cloud security startup Wiz for $32 billion in cash.

This deal exceeds Google’s previous $22 billion offer, which Wiz declined in July while exploring an IPO.

Antitrust concerns initially prevented the acquisition last year, but the new agreement signals renewed confidence in major tech deals under the Trump administration.

Industry analysts, including Brad Haller of West Monroe, see this as a “litmus test” for M&A activity in 2025, with hopes that regulatory scrutiny will ease, allowing for more tech consolidation.

5. Federal Reserve Holds Rates Steady, Investors Await Guidance

The Federal Reserve is widely expected to maintain its current interest rate policy during today’s decision. However, investors will focus on Fed Chair Jerome Powell’s commentary regarding future rate cuts and economic outlook.

Dan North, senior economist at Allianz Trade North America, noted: “There’s no chance of a cut Wednesday, so all the other stuff becomes more important.”

Powell has previously stated that the Fed is “well-positioned to wait for greater clarity”, signaling a cautious approach amid uncertainty surrounding Trump’s fiscal and trade policies.

Market participants will analyze the Fed’s tone on inflation, employment, and recession risks, as any hints about future policy shifts could significantly impact investor sentiment.

Key Takeaway

Today’s market movements will be shaped by the Federal Reserve’s decision, Nvidia’s AI advancements, Google’s acquisition, and geopolitical developments. Investors should remain vigilant as volatility persists, and economic uncertainty continues to drive market sentiment.

Opmerkingen